Climbing the Wall of Worry

This morning, I was at my parents’ house, and my Dad chatted with me before I left. He said, in so many words, that I was probably a bit too bearish right now. It was likely in response to yesterday’s free article (and DP Alert opening) about the diverging short- and intermediate-term indicators. I told him I was cautiously bullish, but that something didn’t sit well with me after this week’s trading, though I couldn’t put my finger on it.

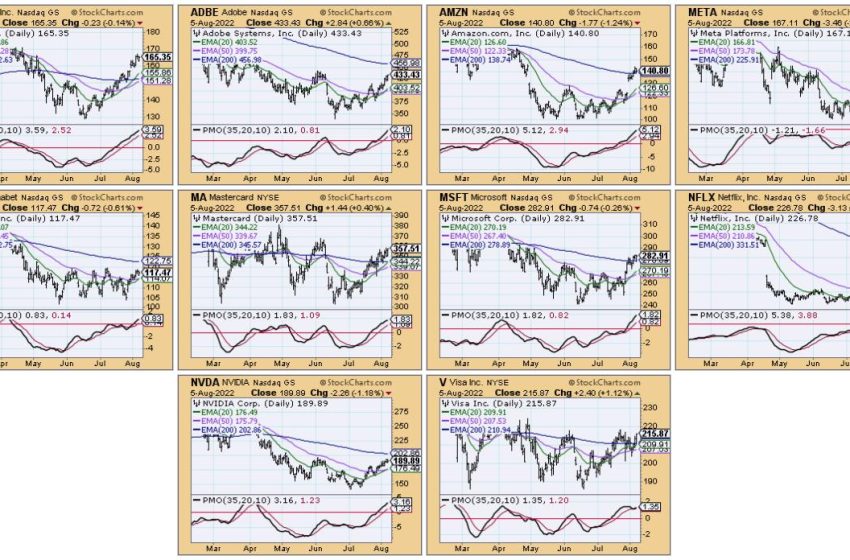

Carl told me that he was looking at the top ten capitalized stocks in the S&P (shown below) and the charts looked bullish. These heavy hitters lead the market and, if they are doing well, the market tends to follow. I looked at the CandleGlance below and I was struck by the same thoughts. Other than META, the charts were all bullish. All but META have garnered IT Trend Model “Silver Cross” BUY signals (20-day EMA crosses above the 50-day EMA) and all are in rising short-term and even intermediate-term trends in some cases. Overhead resistance has been overcome by a handful (MSFT, AMZN and AAPL) and, for those that haven’t overcome resistance levels, the indicators suggest they will.

Don’t get me wrong, we both agree that the bear market isn’t likely over, but this looks like the rally should continue. After reviewing the charts, I realized my sticking point: the SPY’s inability to overcome resistance this week alongside Swenlin Trading Oscillators (STOs) that are pulling back. Yet participation is still healthy.

Oftentimes, indicators will pullback out of overbought territory, basically unwinding overbought conditions while price consolidates. This could be exactly what is happening. I am reminded of the saying, “Climbing the Wall of Worry”.

Good Luck & Good Trading!

Erin Swenlin

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2022 DecisionPoint.com

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

Trend Models

Price Momentum Oscillator (PMO)

On Balance Volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear Market Rules

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.