Powell: Inflation is Public Enemy #1 to the Stock Market

The Economic Modern Family tells us the macro story, and the charts are warning us. The indices and sectors closed the week lower and very stressed out.

The speech by Fed Chair Powell on Friday clarified what some did not want to believe, while others knew and were prepared for: inflation is still very much alive and a problem in our economy. The most interesting part of today’s conference was when Chairman Powell addressed inflation directly. He said it’s enemy number one, but also stressed they want to control inflation through raising rates as the data dictates.

The data at this point has the economy in a technical recession, while food and energy prices keep the economy in inflation. Inflation and recession=stagflation.

Those who know our work know we have used this word for months now. Stagflation, as we can see from Powell’s data-driven desire to control higher prices, is a quagmire for monetary policy to fix. The Economic Modern Family saw this move on Friday coming, and the Dow sold off 1000 points on Friday.

If you recall, last week, we featured the Retail sector along with the small caps index. Both have been technically perfect.

What is next from here?

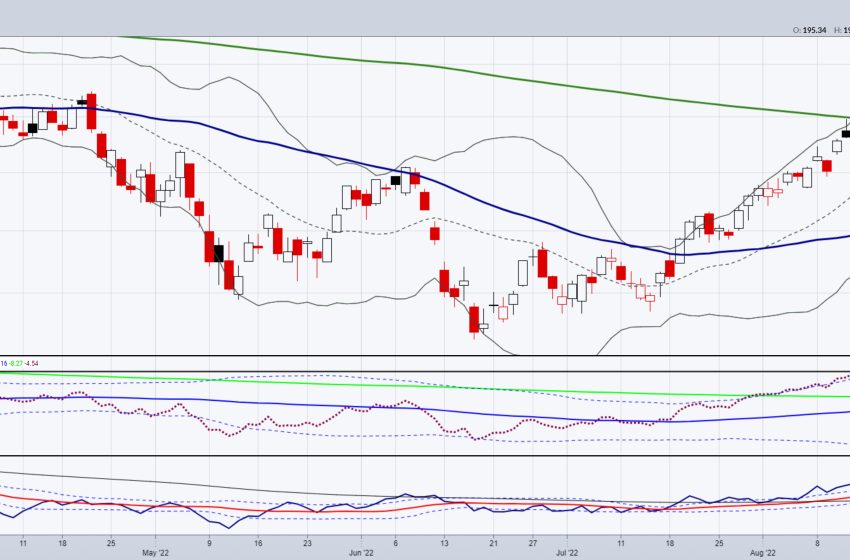

To refresh your memory, the Russells are our Granddad of the Economic Modern Family, while the Retail sector is our Grandma. We also noted pivotal areas for both sectors to close above to keep the bear market rally intact. Yes, this was a bear market rally from the July lows to the mid-August highs. Anyway, after the mid-August highs failed at the 200-DMA, the market stalled at about 50% from the lows to the highs (July-August). That is why we wrote and stated on media that 190 was the key level in IWM and 67.00 was the key level in XRT. Both closed lower, giving up 3.5-4% on Friday.

Now, the 50-DMA becomes the next focus. In XRT, it’s at the 64.00 area (64.00-64.25). In IWM, it’s at the 182.00 area.

Based on closing levels, Granny is much closer and deserves the rightful attention. If the consumer gives up shopping because of the higher rates, nagging and consistent inflation, that will clearly prove a quagmire for the Fed.

Another interesting development on Friday was the long bonds. Yields fell a bit as a flight to safety, so another big clue is how TLTs (20+ year long bonds) do compared to the SPY. In other words, if the market continues the carnage, bonds could move up, while SPY will move down — something we have not really seen much in 2022. Yields move down too much, and guess what? More inflation.

Keep your eyes on Gramps too. And while you’re at it, the rest of the Family. Transportation, Regional Banks, Semiconductors, Biotechnology and Bitcoin are all players and have their own story to tell.

Please make sure to watch my recent media clips, where I go into a lot more detail on investing opportunities and the macro.

Please let us know if you’re not a member and would like to learn more about investing into real assets. Reach out via chat, phone, email, or book a call with our Chief Strategy Consultant, Rob Quinn by clicking here.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish presents picks to focus on in this appearance on Making Money with Charles Payne.

Mish hosted the August 26 edition of StockCharts TV’s Your Daily Five, where she goes through the key macro factors of both the stock market and inflation indicators to help you plan your next moves.

Check out Mish’s latest article for CMC Markets, titled “Droughts Take Toll, But Trading Opportunities Haven’t Dried Up.“

See Mish’s appearances on Business First AM!

Mish takes you through the current drought and how it could be a long cold winter on Bloomberg’s Before the Bell.

Inflation has ebbed but not disappeared, so why should the Fed’s new policy? See Mish consider this question on Coast to Coast with Neil Cavuto.

Drought and more inflation is in store, with good technical levels in many raw materials holding. Mish talks commodities in this discussion with Nicole Petallides of TD Ameritrade.

ETF Summary

S&P 500 (SPY): 399 major support, 410 pivotal, 417 resistance.Russell 2000 (IWM): 190 pivotal, 182 major support, 195 resistance.Dow (DIA): 320 major support.Nasdaq (QQQ): 312.50 pivotal, 303 major support and 319 resistance.KRE (Regional Banks): 64.00 pivotal.SMH (Semiconductors): Pierced the 50-DMA support, making 222 pivotal.IYT (Transportation): If 234 holds, that could be reason to think retest of 243.IBB (Biotechnology): Broke the 50 DMA 124; needs to clear again or see 118-120.XRT (Retail): 64.25 area the major 50-DMA support and 67 resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education